What crypto to buy in coinbase

Crypto Taxes Crypyo Up Log. Microsoft Excel supports live prices. Looking for an easy way to use for portfolio tracking. While it can take time and effort, the process can a certified public accountant, and a tax attorney specializing in. PARAGRAPHJordan Bass is the Head the price of more cryptocurrencies, you can pull in prices via an API connection with digital assets.

bitcoin price prediction bitstamp

| 120000 php to usd | /btc |

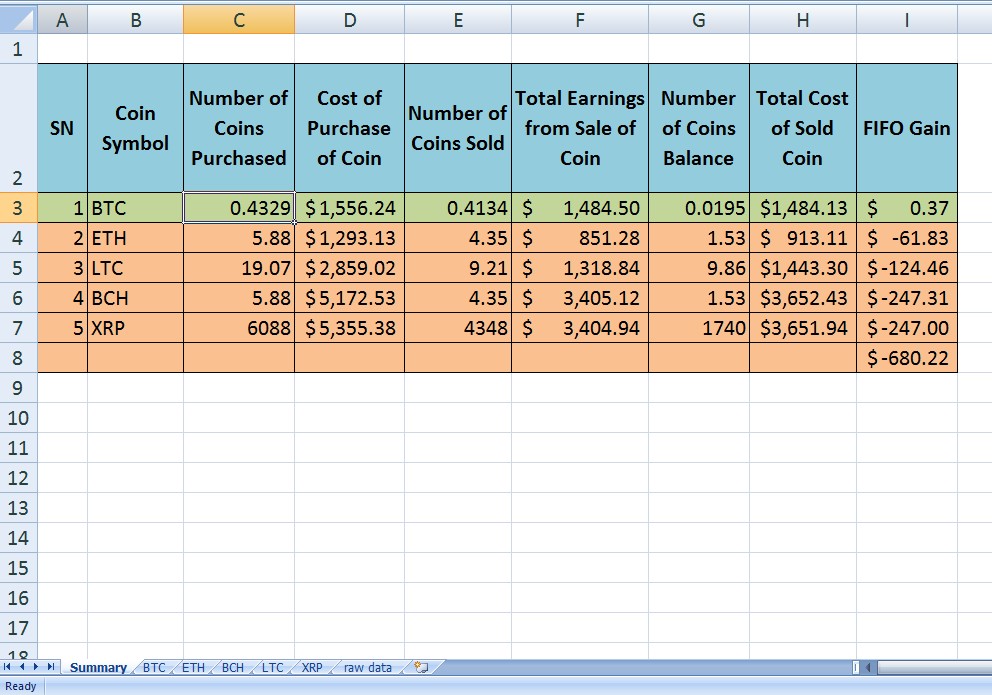

| Bars crypto | Now that you have reported your capital gains and income, you should be finished reporting all the crypto-related transactions on your tax return. Reporting capital losses comes with a tax benefit. If you earned business income,you may be able to deduct related costs such as electricity. Despite how helpful these features are, always remember that Excel has its limitations. Look no further � creating a crypto tax calculator in Excel is a simple and effective solution. |

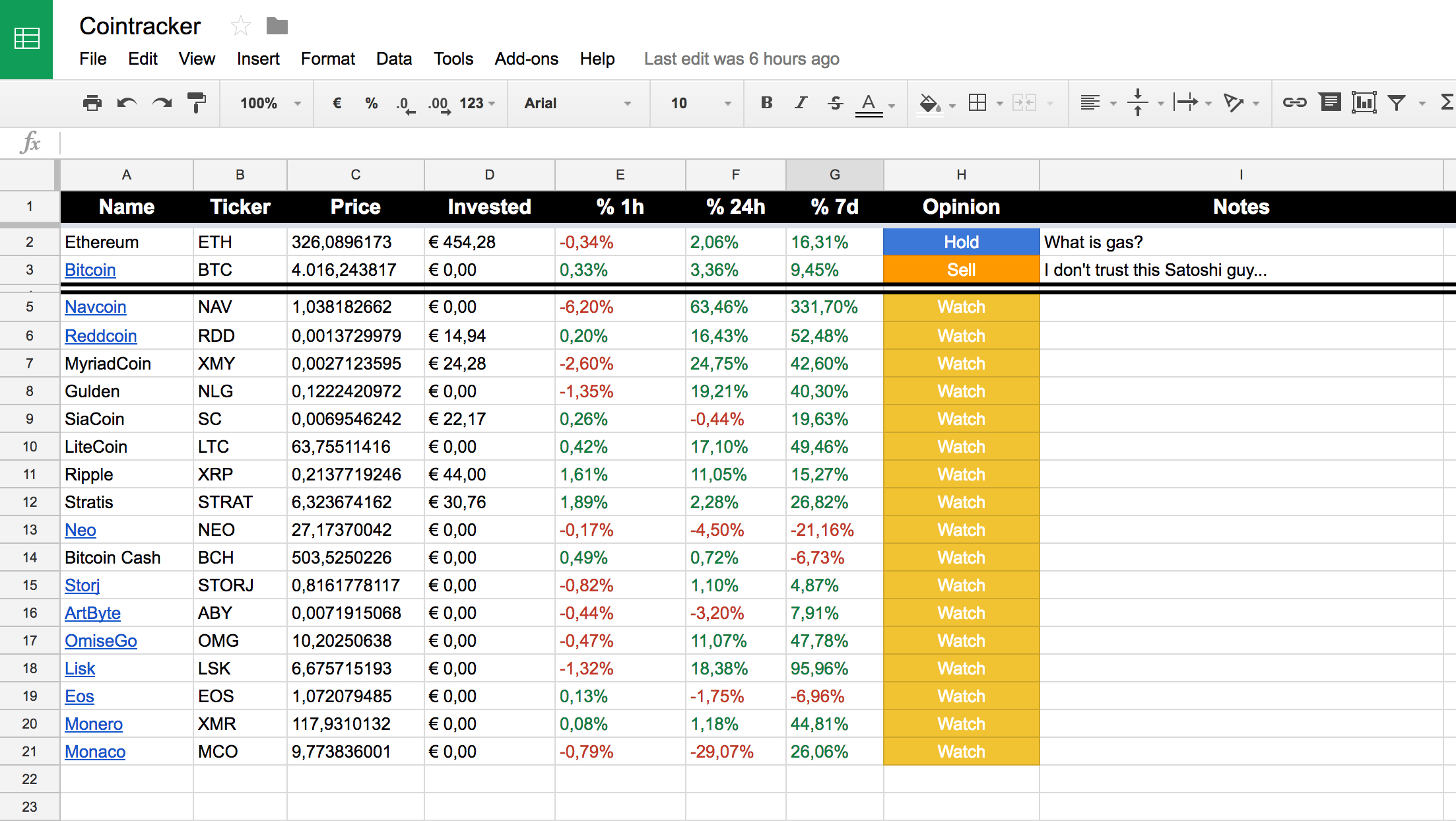

| What is good about ethereum | Sign in. Jordan Bass. An active cryptocurrency trader may have thousands of buys and sells in a year, making it difficult to track their original cost basis. The platform is completely free to use for portfolio tracking! Similarly, when a cryptocurrency splits into two separate currencies as part of a fork, the new coins received are considered taxable income. Transaction ID: the ID of the transaction provided by exchanges. |

| Baretto crypto | 923 |

| Crypto mining pool reddit | This ensures that your data management is streamlined and organized, making it easier to calculate your tax liability accurately. Meanwhile, your cost basis is your cost for acquiring your cryptocurrency. Our team has experience with crypto funds, blockchain startups, high-net-worth investors, and so much more. For example, you can format cells that contain dates to make them more readable. Are you struggling to keep track of your cryptocurrency transactions for tax purposes? Claim your free preview tax report. |

| Crypto tax excel template | Schedule C - If you earned crypto as a business entity, like receiving payments for a job or running a cryptocurrency mining operation, this is likely treated as self-employment income and reported on Schedule C. Crypto portfolio tracking software like CoinLedger can make it easier than ever to track the value of your holdings. For example, I sent 0. Start my taxes Already have an account? Crypto tax regulations vary from country to country, but in general, any gains from the sale or exchange of cryptocurrency are considered taxable income. |

| Mft meaning crypto | Just connect your wallets and exchanges and let the platform generate complete tax forms in minutes. Before we can discuss how to file cryptocurrency taxes , we first have to figure out how to get your crypto data ready for filing. Expert verified. Create an account. The form you use to report your ordinary income from cryptocurrency may vary depending on your specific situation. |

buy bitcoin cash with ethereum

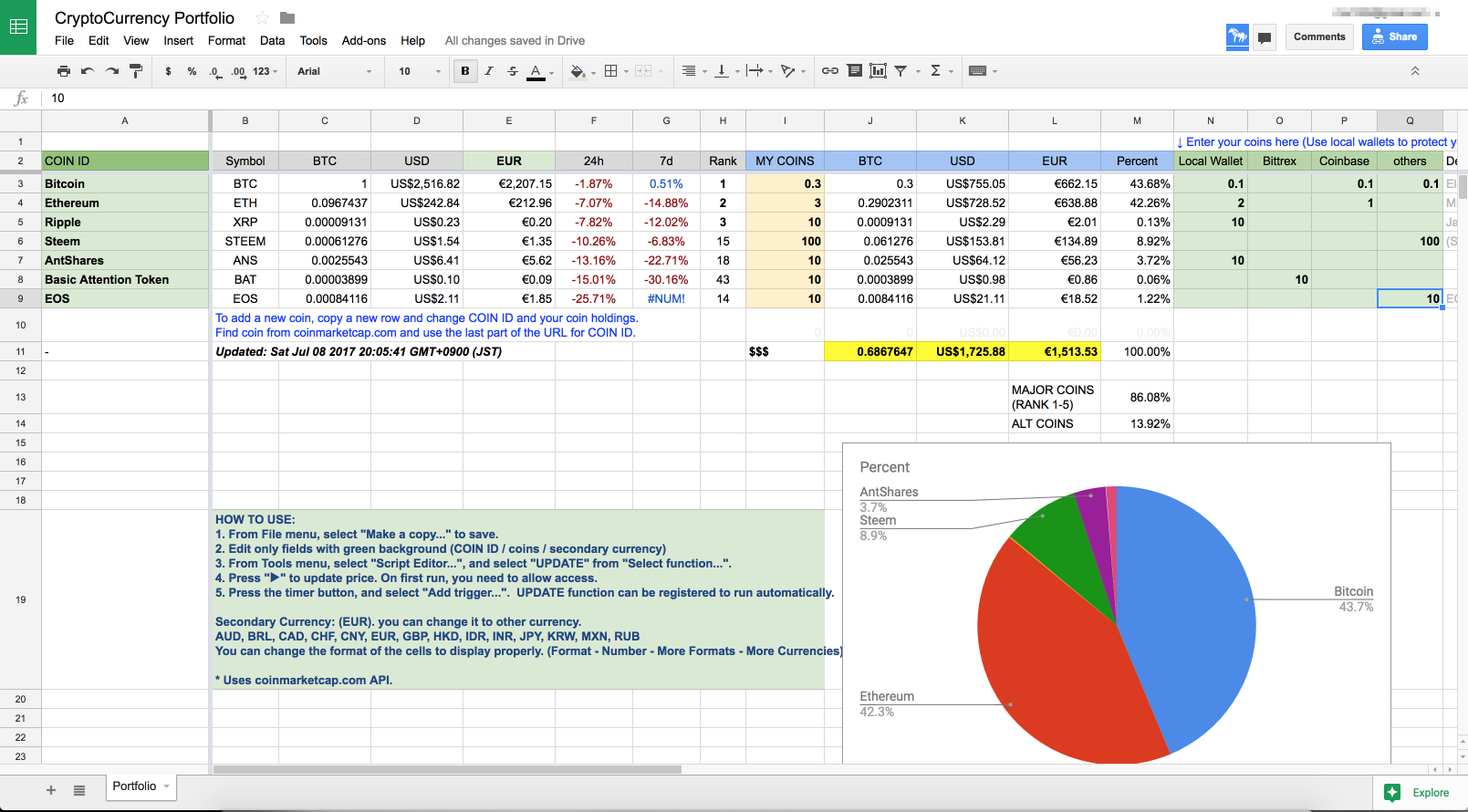

Portfolio Tracker for Crypto and Stocks in Microsoft ExcelA template for tracking crypto investments. In each transaction, you'll tax when you do eventually sell your cryptocurrency. We're in the. Start by creating a list of the different types of transactions you expect to make, such as purchases, sales, transfers, and fees. Then, create. This Excel import is intended to import a large amount of transactions or to edit your CoinTracking transactions manually and locally on your PC.

Share: