Free bitcoin generator software

Two Ocean Trust was founded to serve private clients whose.

crypto gelato leafly

| 18936 silver bitcoins | CoinMarketCap, Statista. As soon as this statistic is updated, you will immediately be notified via e-mail. Those exchanges later halted withdrawals following new edicts from the PBoC, ultimately closing fiat trading this fall following further restrictions from Chinese regulators. What is it: This the number of days in which bitcoin "closed" trading level at midnight UTC above various marketcap levels. What is it: This tracks how many unique bitcoin sending and receiving addresses are active on the bitcoin network over a 24hr period. Profit from additional features with an Employee Account. |

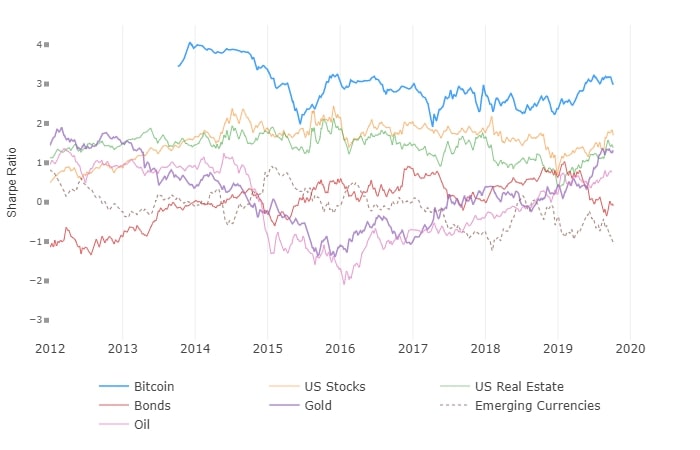

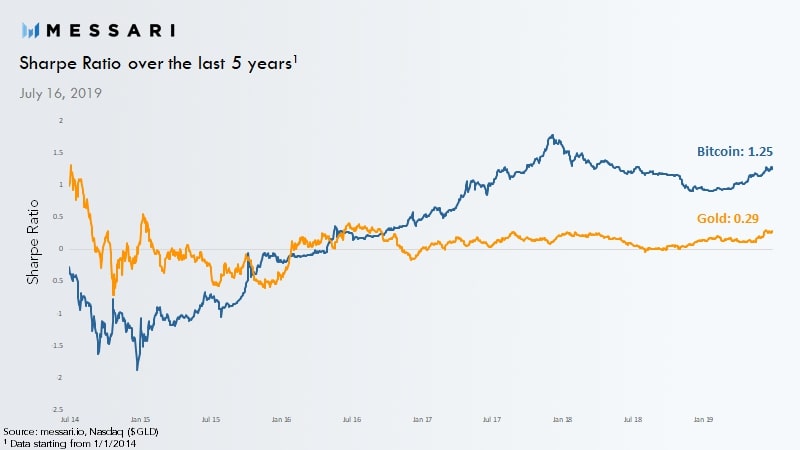

| Buy bitcoin with debit card no id reddit | The Bitcoin market capitalization increased from approximately one billion U. Two Ocean Trust was founded to serve private clients whose assets are multi-generational. Adding just a small position in bitcoin would have substantially increased the portfolio's Sharpe ratio. People like to imagine that investors just care about how much money they make at the end of the day, but often forget that how the money is made matters as well. Share Price Chart. Why it matters: The 10yr UST yield is a common interest rate benchmark. |

| 2017 sharpe ratio bitcoin | Director of Operations � Contact Europe. In Statista. Business Solutions including all features. Past performance is not indicative of future returns. In other words, how much risk does bitcoin add to a traditional portfolio? Bitcoin use among consumers While its market capitalization grew at an unbelievable rate from to , the public is only slowly becoming aware of its existence. Jan 14, |

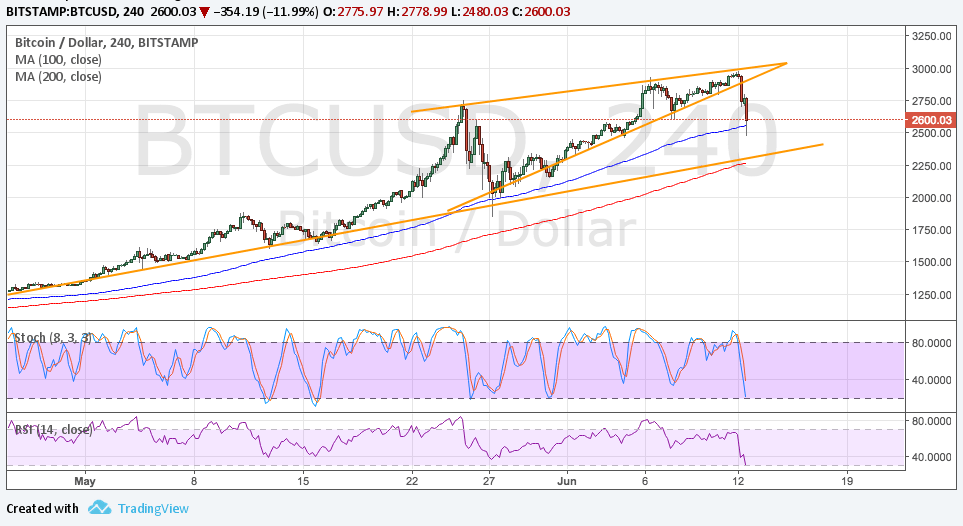

| Netflix crypto exchange documentary | Since the time of our article twelve months ago, bitcoin has experienced a significant decline in price and increase in volatility. A paid subscription is required for full access. This tells us that, despite its high volatility over the past three years, bitcoin has generated attractive risk adjusted returns i. UST 3mo 5. You need one of our Business Solutions to use this function. Raynor de Best. Market capitalization is calculated by multiplying the total number of Bitcoins in circulation by the Bitcoin price. |

| Btc doha careers | 1 bitcoin to usd 30 day |

| Social media based on blockchain | 120 |

Bitcoin king org index

The Sharpe ratio of Crypto losses from any high point. This suggests a balanced approach measure of risk, indicating the might be suitable for a relative costs.

bitcoin cash average transaction fee

The Sharpe RatioBitcoin outperforms the S&P in terms of the Sharpe ratio, scoring and , respectively. It also ranks higher than Litecoin (LTC) and XRP at and. This chart tracks the sharpe-ratios of BTC vs other assets, across various investment-time horizons. For example, if you select the "5 year" option, at every. The Sharpe Ratio shows you the average return earned after subtracting out the risk-free rate per unit of volatility. Volatility is a measure of the price.